Acquisition project | Svami Drinks

- Novela Patrao

The Story

It's the year 2018, and there's an uproar of Gin Drinkers in Tier-1 cities, all thanks to our homegrown Gin brands. That was when co-founders Annesh, Sahil, and Rahul came together to revolutionize the beverage industry. Given their collective experience and understanding of the space, beverages seemed like a natural choice. The vision was clear - to offer people an 'upgrade' and carve a niche in the non-alcoholic segment, which, at that time, was largely dominated by just a few global players.

We began our journey by focusing on tonic water, recognizing a significant gap in the market dominated by Schweppes. With the growing popularity of gin, there was an evident need for an upgrade, which led to the inception of our beverage startup, Svami Drinks, and its flagship product. Over the past five years, our Mumbai-based startup has built an extensive portfolio comprising 12 products spread across three major categories - mixers, non-alcoholic ready-to-drink (RTD), and other beverages.

The company was later acquired in 2022 by Third Eye Distillery, valued at 100 crore with a 51% stake acquisition.

Svami's Range includes Tonic Waters (Original, Light, 3 Cal, Grapefruit, Cucumber), Soda, Non-Alcoholic Range (Gin and Tonic & Rum and Cola) and Ready to Drink (Salted Lemonade, Ginger Ale)

Product's Market Presence

Svami has its own website

It Retails across 2000+ stores across 35+ cities and 5 countries

It is available to purchase on Amazon, Swiggy Instamart, Blinkit, CRED and Dunzo

40% of sales contribute to Retail channel, while 25% is Horeca

Retail Stores

Digital

Google & Amazon Search results for keywords

Svami partnerships with events

Svami's Bar Setup in collaboration with Alco-Brev brand at top events across the country

Svami Collaborated with the Singapore Tourism Board and Superkicks and created limited edition Pandan Tonic and Vanilla Cola respectively.

-

Youtube (Organic Collaborations)

Social Media

Understanding the customer

A total of 5 customer calls, 3 Internal team users including bartenders, and 2 shop owners were interviewed to understand the product market perception.

Top Macro and Micro Objective

MACRO: Understand consumer's knowledge, buying habits and preferences for mixers

MICRO

--> Understanding different consumer segments and their lifestyle

--> Are people consuming mixers, are they aware of the product?

--> What are people's patterns and goals while socialising

--> What are the needs of the customer

--> Is buying mixers a luxury, and how much are people willing to spend on this?

--> What are the consumption patterns and top shopping preferences

Top Questions for User Calls

1. How would you describe your social life? Do you host house parties, or attend parties?

2. Do you consume alcohol? What are your go-to drinks?

3. What mixers do you ideally use for consumption?

4. What do you find yourself reaching out for when you wish to drink something other than water?

5. Do you enjoy cocktails/mocktails, do you make them?

6. What's your biggest challenge when it comes to consuming tonic and mixers?

7. What influences you when trying out a new product?

8. How do you usually shop? Online, Stores?

Some Key Insights from Users

"I'm unaware of where I can find good mixers"

"I'm not sure, how to use the product"

"I avoid mixers because they contain sugar"

ICP's

Metrics | ICP 1 | ICP 2 | ICP 3 | ICP 4 |

|---|---|---|---|---|

ICP | Occasional Social Drinkers | Regular Drinkers/Cocktail Enthusiast | Premium Beverage Drinker | Non- Alcoholic Drinkers |

Bio (Age, Gender, Location) | Age 23-45 years, Any, Living in Tier 1/Tier-2. These are ideally corporate employees. | Aged 25-40 years, male or female, Tier-1, urban areas. Most likely to be living alone | Aged 20-35, male/female, in urban areas in upscale neighbourhoods | Aged 8-65, Male/Female. Lives in urban and tier-2 cities |

Demographics (Work, Salary, Relationship, Education) | Works in an MNC in mid-management roles, with an average salary of 4,80,000- 12,0000. Holding a Graduation or MBA, either single or married | Work in emerging startups with a salary range of up to > 25,00,000. Diverse education from self-taught to advanced degrees with certifications. Remote workers.Many unmarried or newly married | Professionals in high-paying positions, business owners, executives, High-income bracket, Married or Single, enjoy entertaining guests, Industry experts | Diverse occupations, including students, professionals, and homemakers. Varied income levels, can be single and living in large families |

Psychographics ( Interests, Lifestyle, Values, Preferences, Attitude) | Interested in entertainment, and sports. Have stable incomes, and busy schedules and prefer being social for the weekends. Prefer convenience. Look for quick and easy solutions and invest in reputed brands. | Interest in entertainment, social events, entrepreneurship, health and lifestyle. Value networking and growth. Prefer work-life balance and dynamic working environment. Creative and flexible. Early adopter, risk-taker, seeks differentiation | Interested in Fine dining, and gourmet experiences. Is Sophisticated, has frequent social engagements, and discerning taste. Values Quality, exclusivity, and prestige. Willing to invest in high-quality products for the sake of enjoyment and status | Interested in Health and wellness, family activities, and socializing without alcohol. Prefer flavourful and refreshing options. Open-minded towards exploring non-alcoholic alternatives, prioritizes health and social inclusivity |

Behavioural traits ( Purchasing habits, preferred communication channels, product adoption) | Purchase frequently through Q-Comm, and use social media. Can be reached through corporate events, conferences, and platforms like Linkedin. Make decisions based on ads, and peer reviews. Likely to adopt product occasionally | Open to trying new products, experimental, influenced by peers and industry trends, Can be reached through newsletters, networking/social events, and communities. Innovative and adaptive to new products | Willing to pay premium prices for exceptional quality and frequent visits to upscale establishments. Reads High-end magazines, and luxury lifestyle blogs, and attends exclusive events. Emphasises experience and appearance | Actively seek out non-alcoholic options, price-sensitive, value transparency and authenticity. Can be reached through community events, family gatherings, weddings and social events. |

Influencers | Recommendations from colleagues, Brands endorsed by industry leaders or celebrities | From peers to increase social status and upgrade their lifestyle. Influencers and KOLs | Recommendations from renowned chefs, sommeliers, or mixologists. Prestigious Awards | Recommendations from health experts, nutritionists, or influencers promoting sober living |

Blockers | Reluctant to switch to new brands, lack of time and exposure for trying new products. | Perception of overpricing without quality. Brand Loyalty or Affiliate | Negative reviews from trusted sources. Product lacking exclusivity | Negative perceptions about the taste or quality of non-alcoholic beverages. Limited availability |

|

ICP Prioritisation Framework

ICP | Adoption Curve | Frequency of use case | Appetite to Pay | TAM | Distribution Potential |

|---|---|---|---|---|---|

Occasional Social Drinkers | HIGH | MEDIUM | MEDIUM | MEDIUM | HIGH |

Regular Drinker/ Cocktail Enthusiast | HIGH | HIGH | MEDIUM | MEDIUM | HIGH |

Premium Beverage Drinkers | MEDIUM | HIGH | HIGH | LOW | LOW |

Non-Alcoholic Drinkers | LOW | LOW | MEDIUM | HIGH | HIGH |

TOP TWO ICP IN FOCUS FOR ACQUISITION

- ICP-1: Regular Drinkers/Cocktail Enthusiast

- Regular Drinkers are already in the lookout for what's one in the market.

They are more likely to little premium for discovery and will stick if they like something

However, their appetite to pay is lower as they indulge often and looking for the best value for money

- Regular Drinkers are already in the lookout for what's one in the market.

- ICP-2: Occasional Social Drinkers

- They drink socially, hence they are likely to indulge once in a while.

They also drink for the social status and are likely to try something that's trending

There's also a good TAM for this group, hence CAC would also be lower

- They drink socially, hence they are likely to indulge once in a while.

'In 2023, India's alcoholic beverage industry saw a surge in premiumization driven by a 22% increase in the launch of Indian spirits brands. A survey of 125 bars revealed equal consumer preference for international and local brands. Brands investing in on-trade promotion saw a 14% rise in sales.'

As per a survey on - What's India is Drinking, derived from 125 bars across India

This talks about how the alco-brev sector is going to see growth, with events like Gin Explorer, Vault Biennale, India Cocktail Week, consumers are only becoming more aware and hence the main problem to solve becomes discovery and accessibility.

Product Market

After conducting user calls, I figured some of the top user problems and their ideal search intent, with auto sentence finishers and other search results, below 3 brand stood out as the highest competitors

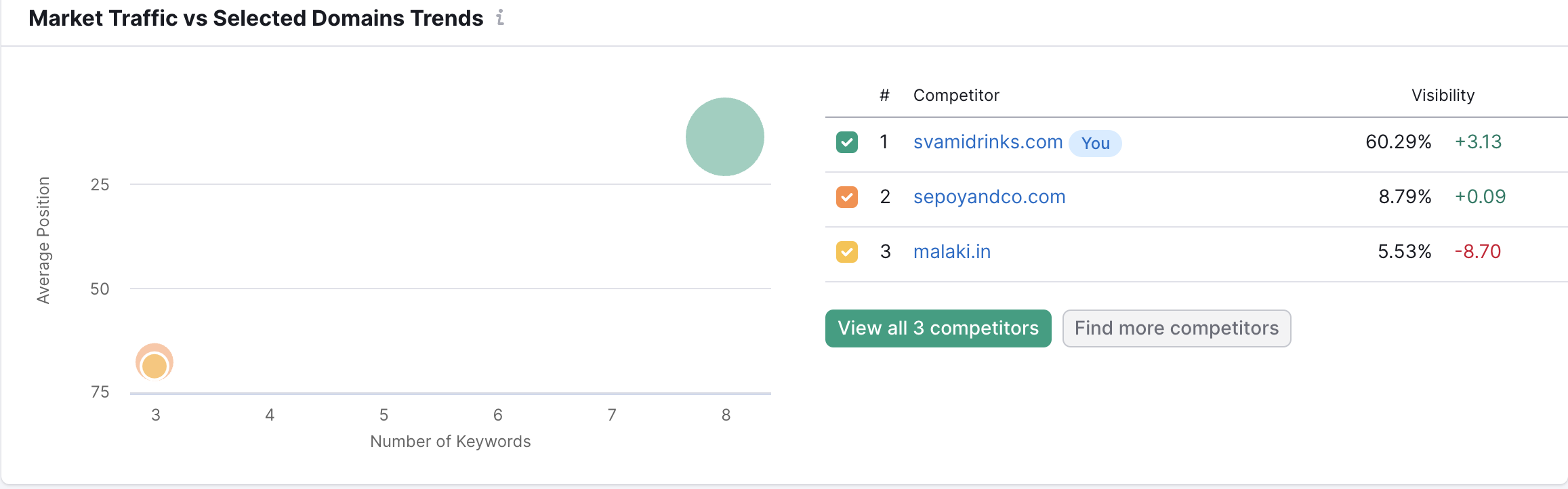

Keyword and Organic Positioning among Competitors

Competition 1: Sepoy

About

Sepoy Tonics is a brand known for its range of tonic water and mixers. Their top-selling products include classic tonic water, ginger ale, and bitter lemon, offering a refreshing addition to various beverages.

Reason:

Sepoy seems to be extensively investing in Svami's Keywords, Additionally, they also have the second most share when it comes to tonic water consumption and awareness post-Svami

Competition 2: Jimmys

About

Jimmys is a brand that specializes in crafting premium cocktail mixers and syrups. Their key products include margarita mix, mojito syrup, and bloody mary mix, providing convenient options for creating cocktails at home.

Reason:

Jimmy's tho not a direct competitor, they have turned to become well known and hold some market share for new consumers who are looking to try out mixers. Jimmy's competes on discoverability and ease of use. (They share recipes on the back of the bottles, which customers pointed out helps in ease of use)

Competition 3: Schweppes

About

Schweppes India is recognized for its wide array of carbonated beverages and mixers. Their top products include club soda, ginger ale, and tonic water, serving as popular choices for mixing with alcoholic beverages or enjoying on their own.

Reason:

Schweppes come as a household name when it comes to tonic waters, being the oldest player, this internationally known brand is popular for its reasonable costing.

Product Positioning

watch video to find TAM - Servicable Portion - Realistic Number

Core Value

Elevate the drinking experience

Key Messaging

To establish Svami as the Master of Mixers

Product Stage - Matured Scaling

Svami spearheads the Mixers industry in India and is an early player with over 5 years of market presence.

Acquisition Channels

ORGANIC SEARCH

Svami Domain Authority in Comparision to its Competitors

its

its

*Google and Amazon SS shared above, in product discovery

Observations:

- It's safe to say that Svami holds a market lead in Organic searches even after not running ADs

- Sepoy and Co runs intensive ADs with Svami keyword bidding, to gain its share of customers

- Svami needs to work on how to increase the duration spent on the web

Solution:

- Svami needs to run hygiene ADs on Google for their keywords

Key Wins and Failures

- Svami is ranking well for most of the products searched for their category

- Some of Svami's key products show up being the only makers

- Svami ranks well for Ginger Ale a key competition product offering but not enough and can do better

- Svami other products like Salted Lemonade need to do better

- Svami can find ways to work with their distributor partners who run Ads for their products.

In addition, it can also make sure the content on the distributor pages are SEO friendly, which will in turn show up in competitor ADs. A good example here is Neelam Foodland, a local store showing up as per my geo-location

Amazon Search

--> Keyword: Tonic water

---> Keyword: Svami Tonic

---> Keyword: Mixers for drinks

Observation

- Competitor Sepoy is dominating the Amazon ADs space, bidding for all relevant keywords

- Another competitor is Schweppes but they arent focusing on ADs

- Some other prominent brands occupying the space include Bombay99, Peer - their keywords would be easier to target.

Solution

- Svami needs to work on product descriptions and bullet points

- Svami needs to create better A+ content that highlights the product core feature, share recipes, comparisons among products and high-quality imagery

- Svami needs to focus on upgrading its image quality and make use of the video feature

- There are plenty of untapped keywords which can be looked into

Content Loops

Content Loop | Hook | Generator | Distributor |

|---|---|---|---|

Social Media - Instagram/YT Videos | Visual Cocktail Recipes and Mixology Tips | In-house mixology team and agency | Social Media Viewers, Influencers & Brand Ambassadors |

Email Marketing | Exclusive Educational and Promotional Content | Marketing Team | Email Marketing Platform. CRM Tools |

Website Blog | Informational Content on Market Trends | Content Writers - Subject matter experts from the Industry | Website Team |

Partnerships & Collaborations | Co-create content with bars and influencers | Marketing and PR team | Partner Venues, Influencer Network |

Community Engagements | Participate in Online forums and Groups | In-house marketing and content team | Platforms like Quora |

We will prioritise Partnerships and Collaborations based on their effectiveness, but also to leverage Svami's network and position itself as 'Masters of Mixing' by standing out.

Collaborating with bars, restaurants, influencers, and industry experts provides an opportunity to tap into existing audiences and communities. Partnerships offer a more targeted approach to distribution, leveraging the trust and credibility of partner brands or individuals to amplify Svami's message and reach a highly engaged audience.

Here's a flow diagram representing how it may unfold

- Content Creator: Svami and Bar Partners - Svami collaborates with bars to create engaging content on mixology, cocktail recipes, and brand stories.

- Content Distributor: Svami's Website and Partner Venues - The content is published on Svami's website and shared by partner venues on their platforms.

- Distribution Channel: Social Media and Email Newsletters - Users share the content on social media, and Svami includes highlights in its email newsletters.

Referral Program

The best way to implement a referral program in Svami would be by introducing a Svami Bar Ambassador Program, as an everyday customer doing this will turn into looking like an MLM scheme

Svami Bar Ambassador Program

Program Overview

The idea for the program will be to aim to collaborate with bartenders, mixologist and industry influencers across the country, by allowing them to apply to become 'Svami Bar Ambassadors' and in return influence within their workplaces and influence their community

Svami's Bar Ambassadors will also receive exclusive benefits and opportunities to engage with Svami's audience.

Benefits to Svami:

This drives Swami's brand awareness and customer engagement

Additionally, it will help in reaching more bars across the country for HORECA partnerships

Products Platform Currency

- Money: Chance to earn cash commission on an affiliate link

- Fame: Recognition as a Svami Brand Ambassador.

- Access: Getting access to exclusive events, Svami's network

-

Influencer Reach and AHA Moment:

Ambassadors use their influence and expertise to connect with customers by recommending Svami and sharing engaging content. By showcasing Svami in their cocktails and creating engaging content, Ambassadors create an 'AHA' moment that inspires customers to try Svami for themselves.

Product Integrations

ICP: Metro Cities, 20-45 years

What Products they use | Swiggy | Spotify/YT Muisc | BookMyshow | CRED | |

|---|---|---|---|---|---|

How frequently do they interact with them? | Very High | High | Moderate | Moderate | Moderate |

How important are | Important | High | Moderate | High | Moderate |

Can Svami add Value | Moderate | High | Low | Moderate | Moderate |

Time to go live | High | Low | High | High | Low |

Tech Effort | High | Low | High | Low | Low |

New Users we can get | High | High | Moderate | High | High |

Svami's focus is to be seen in front of more relevant ICP and allow them an option to try the product. Platforms like Swiggy and CRED make them possible as they allow in-app shopping. So we will explore Svami's integrations with CRED

Svami inside CRED

- CRED has gamified it's shopping and brand offers experience, which make CRED users excited to try them. Svami can offer exclusive deals within the CRED app which can get users to buy and try the products.

- CRED can offer Svami eyeballs to its ICP, which fits right into Svami's ICP

Here are some ideal discovery points on CRED:

- User opens CRED to pay its bill and check what's new

- User stumbles upon 'Rewards' on the homepage - Svami can be integrated with a discount to shop from the website here

- Users go to the Shop section and find Svami in the 'DEAL OF THE DAY' section

- User find Svami in one of the highlight sections on CRED

- User searches for 'Svami' and discovers more products

Svami also announces to its audience about being on CRED, which get's their current users to visit CRED for better deals

Paid Advertising

After considering CAC, where my ICP 1-2 is spending more time, plus the highest returns the channel for acquisition is Swiggy Instmart (In-app Paid Promotions)

First, we see potential spots where Swami can be promoted

,

,

Second, we figure out the costing with the internal team and try to figure the CAC

Example: On an average Svami has to spend monthly 2lac to Advertise on Swiggy, we are seeing a purchase of 5lac per month currently without any ADS, however, if we can pick 1-2 of the likely advertising spots we can leverage more eyeballs

Third, say the deal is through, these are the messaging we will use to promote Svami on Instamart

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.